Deal closed today

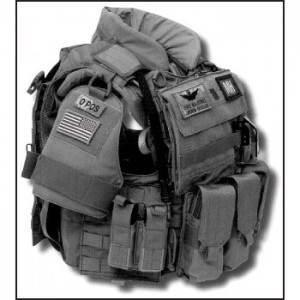

Eagle Industries' Combat Integrated Armor Carrier System

Alliant Techsystems Inc. today purchased Eagle Industries Unlimited Inc. for an undisclosed amount. Alliant is a Minnesota-based aerospace and defense company. Eagle makes nylon safety gear for the military and law enforcement agencies.

More on Eagle Industries

Eagle makes several products, most of them nylon-based. The company sells weapon holsters, bags, rappelling equipment and vests. The company has about 2,300 employees. Eagle headquarters is in Fenton, Mo.

It also has facilities in New Bedford, Mass., Lares and Mayaguez, Puerto Rico, and the Dominican Republic. Its main client is the U.S. Department of Defense. It’s possible military loans made up part of the company’s earnings.

More on Alliant Techsystems

Alliant is commonly known by its ticker symbol, ATK. The large aerospace and defense company has revenue of more than $4.5 billion. ATK has more than 19,000 employees.

Eagle will add more than $80 million to Alliant’s sales in fiscal 2010, according to Minneapolis/St. Paul Business Journal.

Everybody’s happy

Both Eagle Industries and Alliant Techsystems see the acquisition as a positive step. ATK is looking forward to expanding.

Eagle will provide Alliant "with an exciting opportunity to expand its presence into the growing military and law enforcement accessories markets," ATK chairman and CEO Dan Murphy said in a statement. ... click here to read the rest of the article titled "Eagle Industries Sold to Alliant Techsystems"

If the current recession economy has taught us anything, it’s that no matter how strong a position you think you have, no job is completely safe when companies look to downsize. I think there are better ways to handle the situation than putting people who depend upon every penny of their job earnings to be able to put food on the table, but then again I didn’t graduate from executive genius school…

If the current recession economy has taught us anything, it’s that no matter how strong a position you think you have, no job is completely safe when companies look to downsize. I think there are better ways to handle the situation than putting people who depend upon every penny of their job earnings to be able to put food on the table, but then again I didn’t graduate from executive genius school… Susan Tompor of the Detroit Free Press

Susan Tompor of the Detroit Free Press

In

In